Trade Lance; a FinTech providing all round digital solutions to business’ challenges

By Our writer

While businesses are grappling with various challenges as they seek to thrive in today’s competitive environment, it is not easy to come across a firm that offers a range of solutions, to almost all challenges, under the same roof.

However, Trade Lance, an Information and Communications Technology (ICT) firm, has curved itself a slot in that area as it provides digital solutions to most challenges that businesses require to thrive.

The Ugandan firm offers a range of solutions from integration, aggregation, software development and utility payments, among others, to solve day-to-day challenges.

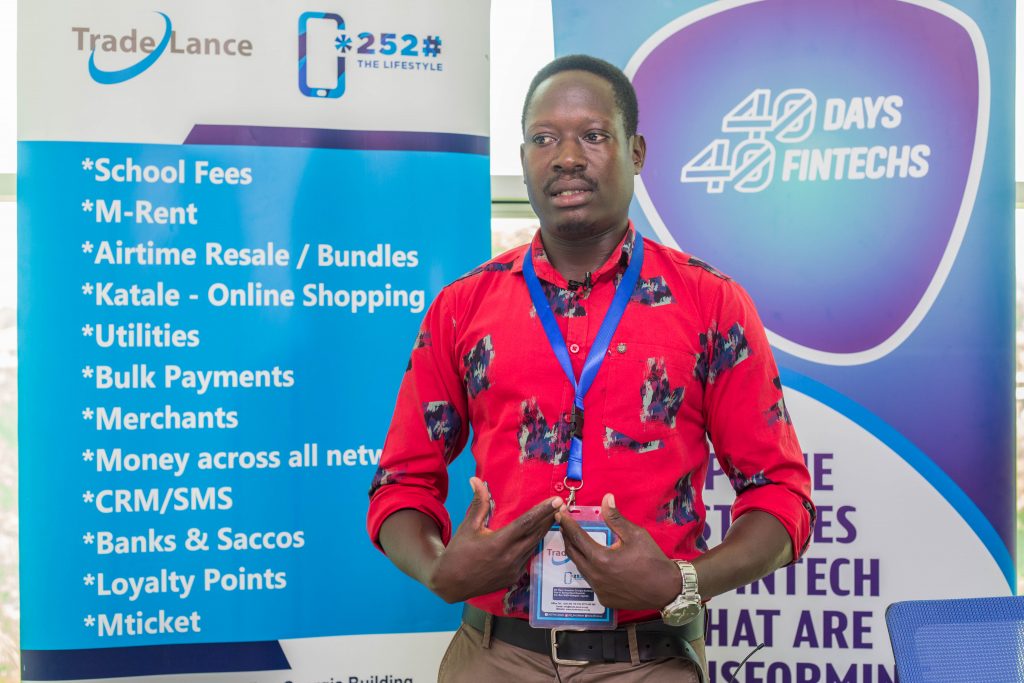

The firm’s Sales and Marketing Analyst Nelson Mandela Ewolu says the company has integrated with major telecommunications companies in Uganda including MTN, Airtel, Africel and Uganda Telecom (UTL) to facilitate smooth mobile money transactions.

It has also aggregated with MTN, Airtel, Africell and Lycamobile, in addition to offering third-party integrations to various companies such as Smile, Roketelkom, Absolute Energy, Cloud Core, Quick Tap, Bright life and Alliance Africa Insurance.

Trade Lance, which boasts of having some of the best software experts in the country, is also in the business of customized software development; it for instance develops Micro Loans Software for financial institutions. Some of its visible products include the Yetu loans software, HCH Financial Services, Hot Cash, Sukuma Loans and Yellow Sacco software.

Other software solutions it has since developed are the E-Voting Software for POA Star Search, a Counseling Registration Software for Strong Minds Uganda and Boda Boda Loans Software.

Additionally, the firm offers a bulk payments solution to mobile money registered numbers. Key among its clients on this solution are Roke Investments and Fireworks Advertising, among others.

Given the increasing cry for mobile money interoperability, Trade Lance allows sending of money across networks, making it easy for people to transact at affordable rates, irrespective of the network they are using.

Their other solutions include utility payments, Client Relation Management Solution, M-Ticket Solution, School Fees Payments and Katale Online Shopping. Trade Lance is also very famous for its *252# financial inclusion USSD and website.

As a firm that participated in the 2020 40-Days 40 FinTechs initiative, Ewolu says among the key takeaways was implementing financial inclusion best practices.

The firm has since implemented some of best practices such as the Low Cost User devices and Pricing Transparency practices.

Ewolu, however, notes that they are not yet able to settle payments on the same way as their partners such as Airtel money are not implementing it as well, for now.

40-Days 40 FinTechs

Trade Lance is participating in the ongoing second edition of the 40-Days 40 FinTechs organised by HiPipo in partnership with Crosslake Technologies, ModusBox and Mojaloop Foundation, and sponsored by the Gates Foundation.

The initiative, which provides a platform for FinTechs and stakeholders in the digital and financial technology space to exhibit their products and share ideas, seeks to boost the African FinTech ecosystem to enable innovators enjoy sustainable profitability to help them design and deploy affordable and inclusive financial services for the poor.

Ewolu also alludes that the 40 Days 40 FinTechs initiative has provided a platform that brings together all players to share experiences and challenges and devise solutions. This, he notes, that enabled the industry to grow.

While he acknowledges that Uganda’s Fintech industry is growing with the number of transactions increasing, he notes that the public is still skeptical about using digital platforms.

“We still have a lot to do to instill faith. I believe in the next five years it will be booming,” he says.

The HiPipo Chief Executive Officer Innocent Kawooya alluded that FinTech is the launch pad on which the promise of full global financial inclusion will be fulfilled, noting that this edition of #40Days40FinTechs will be Uganda’s most comprehensive foray into things like distributed ledger technologies, Artificial Intelligence, Big Data, Automated Customer Relationship Management, cash management and lending platforms.

“The 40-Days 40 FinTechs LevelOneProject shall show we have the innovators to take on the challenges,” he says.

Kawooya, however, adds that a connecting thread will be how FinTechs urgently need interoperability and thus how open source frameworks such as Mojaloop and other technologies, are here to help, including guiding on how emerging frameworks such as #LevelOneProject principles can be used to engender sustainable financial inclusion impact.