#40Days40FinTechs: SoftPay Is Promoting Cameroon’s Cashless Economy

Our Reporter.

While there has been effort from the various governments across Africa to shift their respective countries from cash to cashless economies, the World Bank estimates that about 90% of retail transactions on the continent are still cash based.

However, there seems to be renewed effort, from all corners to migrate Africa from a cash to a cashless economy.

In Cameroon, the cashless economy drive is being spearheaded by several Financial Technology Companies (FinTechs), one of them being NewLife Technologies Sarl.

NewLife Technologies Sarl is a Cameroon-based mobile application and website development company that was established last year.

The company recently launched a financial inclusion App dubbed SoftPay, a mobile app that uses the scan and pay method, and allows people in poor regions of the world, especially in Africa and Asia to access financial products digitally so as to promote cashless economies.

The company’s founder and chief executive officer, Ngala Cyprian Mufor said the App works without an internet connection, enabling people in remote areas of Africa and Asia who have no internet and those with poor internet connections to enjoy modern financial technologies.

“SoftPay offers cashless payments and one requires no internet to use the app,” Mufor said.

Using the MTN Mobile Money and Orange Money APIs, users can easily load their SoftPay account from any of these service providers as well as withdraw funds from their SoftPay account using their mobile network service provider.

The App is currently free for SoftPay-to-SoftPay transfers, according to Mufor

“We are working to make this service to meet the needs of a wider population in Cameroon and beyond,” he said.

Opportunities

“Africa still has about 66% of the adult population unbanked and this is an opportunity for us to tap into by extending financial services to them,”

Quoting the 2017 Global System for Mobile Communications Association (GSMA) Mobile Economy report, Mufor said that Africa will have more than half a billion unique mobile subscribers by the end of 2020, making it the fastest growing mobile market.

“The challenge will be that people will have problems in loading cash to their wallets as the only form of electronic money available with the common people, especially in Cameroon, are two mobile operators and they pay charges for every transaction.”

He, however, said that they are planning to make transactions free for all users but are still inhibited by the fact that they have to pay the operators.

“To make this service to work internet free, we need funds to negotiate deals and setup infrastructure to make this work. It is a real challenge for us,” he said.

He added that poor infrastructure in Africa including electricity and internet is also still inhibiting FinTechs from extending financial services to the financially excluded people.

Challenges

Mufor, however, notes that transferring money across networks is still very expensive. Also, even when the transfer is done, Mufor said, it is still difficult for a user to withdraw the funds received from a different mobile money operator unto their network.

This, he noted, is due to lack of interoperability.

“If an MTN Mobile Money user receives a funds transfer from Orange Money user, the MTN Mobile money user may never be able to do the withdrawal which means these services are not interoperability,” he said.

He, however, noted that SoftPay is increasingly resolving that challenge by facilitating interoperability.

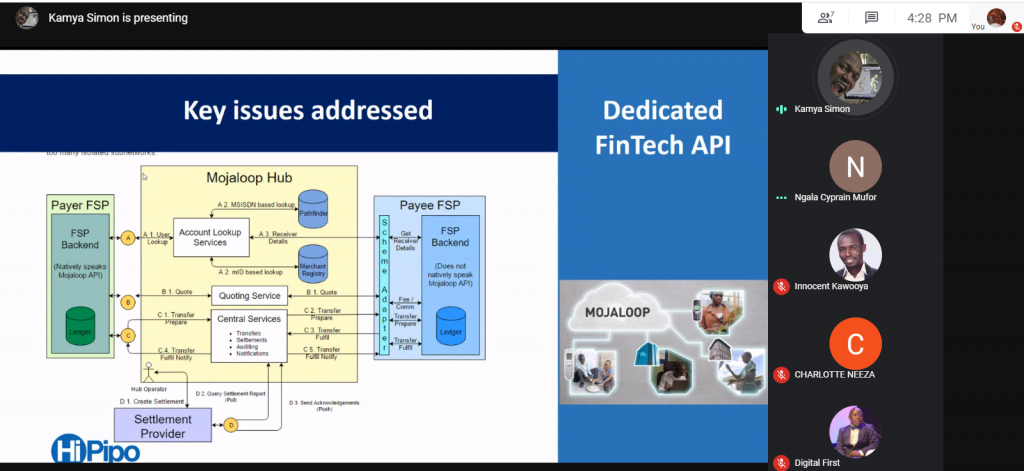

NewLife Technologies Sarl is among the FinTechs participating in the 40-days-40-FinTechs initiatives organised by HiPipo, in partnership with Crosslake Tech, ModusBox and Mojaloop Foundation.

The initiative seeks to enable FinTechs to innovate solutions that facilitate cross-network financial transactions at minimal risks to enhance access to financial services.

Running for 40 days, the project will see the participating 40 FinTechs acquire interoperable development skills to improve access to financial services, using the Mojaloop open source software.

Mufor said the 40-days-40- FinTech initiative will offer them an opportunity to discuss plans and vision for Africa with experts.

“We are open to receiving inputs and recommendations from everyone to add substance to our future plans and products. We are also searching and looking to collaborate with other willing organizations to work together for Africa,” he said.

The HiPipo CEO Innocent Kawooya said that HiPipo and its global partners are committed to supporting the FinTech community across Africa, especially those facing technical challenges relating with creating interoperable digital payment systems and integrations with digital financial services providers such as banks and mobile network operators.

He commended NewLife Technologies Sarl for the Softpay product, saying that once it succeeds in Cameroon, it will give the rest of Africa a successful case study on creating interoperable, seamless and affordable financial services using new emerging technologies like Mojaloop. He added that this would then help many stakeholders to adopt easily.

NewLife Technologies Sarl has a gender bias, 57% of its staff and contractors being women.