KILIMO BaNDO is using Agri-FinTech to unlock opportunities for Farmers. 40 Days 40 FinTechs Tanzania Day 12

Agriculture in sub-Saharan Africa is mainly dominated by Subsistence, Smallholder Farmers and Agro-Small and Medium Enterprises. These collectively contribute greatly to the continent’s Food Basket, enhance Food Security and also employ millions of people.

That said, they face enormous challenges, many of which threaten their long-term survival. Such challenges include limited resources, unpredictable seasons, poor seeds, expensive fertilizers and unstable markets.

It is these challenges that innovators are working in overdrive to address and make Agriculture more attractive and much more profitable.

Among such innovators is BizyTech Limited; a Tanzanian-based company that has developed a transformative Agri-FinTech solution named KILIMO BaNDO.

KILIMO BaNDO offers a digital solution for savings and payment services in rural areas, enabling farmers to access affordable, quality inputs and financing for their farming activities.

The platform also provides an input loan service for farmers who have joined KILIMO BaNDO to support their farming operations with necessary inputs, agricultural machinery, and soil health analysis.

Farmers who have joined KILIMO BaNDO also receive comprehensive crop, health, life, and equipment insurance to protect them from any disasters or issues that could harm their entire production systems.

“Generally, farmers are not financially included in Tanzania. So, we meet farmers, profile them, put them in a group and give them an e-wallet ID. With this e-wallet ID, they can transact through our platform. They can save little by little so that they can buy inputs for the farming seasons. They do this via USSD codes because most farmers don’t have digital smartphones, so they use feature phones. This service enables them to order for inputs and have them delivered to their homes,” Isabella Fernandez, the VP of Business Administration at BizyTech Limited said.

She added: “We enable farmers to access loans, get insurance and also link their products to be able to have maximum yields. We are the infrastructure that links all the services in the agriculture value chain to a smallholder farmer. We work with different financial institutions that give out loans and insurance services. We offer the platform that enables all this.”

Since its launch in 2015, KILIMO BaNDO has continued to contribute to Agriculture transformation in Tanzania. It has handled Agriculture volumes worth over USD 500 million, works with more than 5,000 Agrimerchants and has registered more than 3.6 million farmers including 1.2m that are active every month.

Minus KILIMO BaNDO, BizyTech also has other solutions including the recently launched Kilimo Bima platform; an Innovative Insurance Solution that aims to increase Insurance Adoption among Smallholder Farmers from the current 0.2 per cent to 25 per cent by the end of 2025/2026 cropping season.

Fernandez noted that the main challenges they face include high fertilizer costs, low acceptance of technology among farmers and limited attraction of proper talent to further improve their work.

To this, Fernandez noted: “Being a start-up is not easy and comes with its challenges. The journey has not been easy but we continue to innovate and also bring in consultants to patch up the expertise that we may lack internally.”

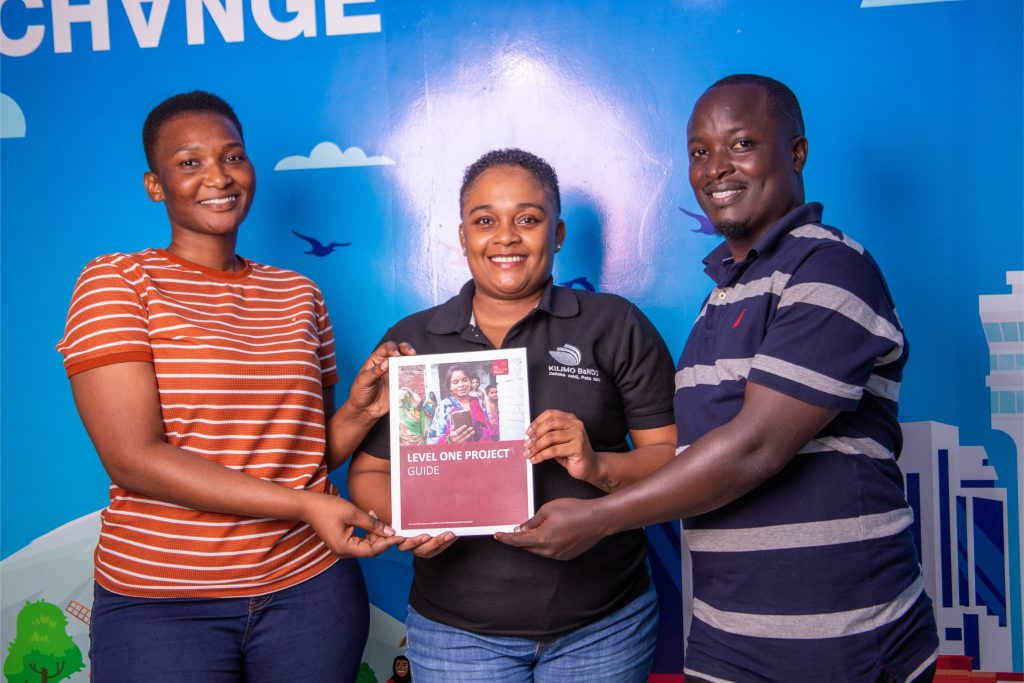

We interacted with BizyTech on Day 12 of 40 Days 40 FinTechs for Tanzania. First implemented in Uganda, 40 Days 40 FinTechs is an annual FinTech Innovation initiative presented by HiPipo to recognize and celebrate individuals and organizations who are making significant strides in promoting financial inclusivity through the use of technology.

It is aimed at promoting innovation and collaboration among FinTechs in Africa. The initiative is designed to provide FinTechs and startups with mentorship, training, exposure, and networking opportunities to help them grow and scale their businesses.

“40 Days 40 FinTechs is a great initiative. It enables us to tell our story through other people. At least we now know that someone out there will listen to our story outside the zones we have been in already,” Fernandez said.

40 Days 40 FinTechs initiative Tanzania is part of HiPipo’s broader Include EveryOne Program that is generously supported by the Gates Foundation and implemented in partnership with Level One Project, ICTC Tanzania, Ideation Corner, Cyber PLC Academy, INFITX, NG Films, Founders Academy and Mojaloop Foundation.

The Include EveryOne program is a beacon of acceleration of FinTech Innovation, empowerment for Women in FinTech and a catalyst for investment and development in the ICT sector. Minus 40 Days 40 FinTechs, other initiatives under the Include EveryOne Program are the FinTech Landscape Exhibition, Women in FinTech Hackathon, Summit and Incubator, Digital Impact Awards Africa and the Digital and Financial Inclusion Summit.

HiPipo is recognized as a premier advocate of digital Innovation and financial inclusion champion, a fervent proponent of the #LevelOneProject. HiPipo has been at the forefront, actively promoting digital innovation, Instant, Inclusive Payment Systems (IIPS), and DFS across Africa. With a legacy of advising, mobilizing, and facilitating the adoption of inclusive financial services, HiPipo’s efforts have been nothing short of transformative! For almost two decades, HiPipo has successfully facilitated the inclusive adoption of these crucial services.