Women in FinTech Hackathon participants introduced to Mojaloop Open Source Software

Our Reporter.

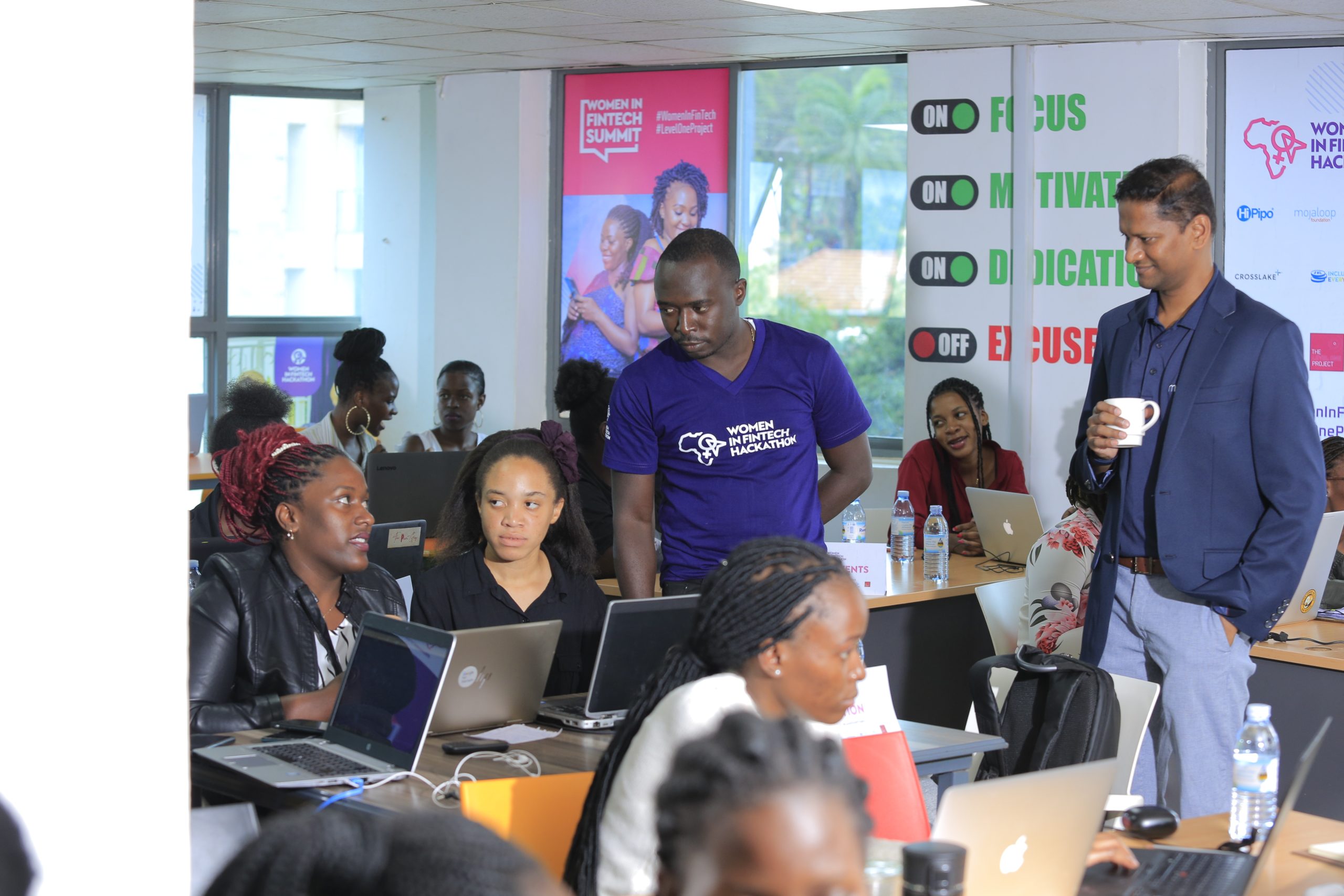

Day three of the ongoing Women in FinTech Hackathon was action-packed, with participants working on their products’ MVP phase one.

In products’ development, MVP stands for a minimum viable product. According to ProductPlan, a minimum viable product (MVP) is a product with enough features to attract early-adopter customers and validate a product idea early in the product development cycle. The MVP is a critical milestone in the product development eco-system.

Minus the MVP, the participants were also introduced to Mojaloop Open Source Software.

According to Sam Kummary, one of the developers of Mojaloop, this software was designed to provide a reference model for payment interoperability. It can be used to overcome barriers that have slowed the spread of digital financial services.

In his presentation, Kummary took the teams through how developers and innovators can freely use the Mojaloop core code, join the community, and build inclusive, real-time payment systems to help support economies. He shared in-depth insights on the Mojaloop scheme, hub and platform and the roles that each play.

“Mojaloop can be used to create interoperable payment solutions in areas such as person to person transfers, payroll and other bulk payments, account management and fraud monitoring,” Kummary said.

On his part, Innocent Kawooya, the HiPipo CEO noted that innovators can use Mojaloop to develop secure and interoperable payment systems that are acceptable globally.

“Payments Schemes around the world are in the process of implementing or considering implementation, of Mojaloop-based interoperable payments systems. Women in FinTech Innovators can use Mojaloop open-source software to support financial services companies, government regulators, and others taking on the challenges of interoperability and financial inclusion,” Kawooya said.

Still on Day 3, the teams were mentored on Product Management. This session was delivered by Mercy Angela Nantongo, the EzyAgric Product Manager.

Nantongo noted that Product Management is a continuous process that ensures that both the product owners and customers get the best results possible.

“Product Management is important as it is the first interaction with customers before any issues arise. It plays a key role in product marketing at initiation, before you build, while building the product, and after you complete the product. Product Management ensures that you are on top of the market trends. It ensures that your customers get the best quality of your product,” Nantongo said.

Organized by HiPipo in partnership with Level One Project, Mojaloop Foundation, ModusBox, CyberPLC Academy, and Crosslake Technologies and generously supported by Gates Foundation, the 2022 Women in FinTech Hackathon has brought together 20 women-led teams this year. The week-long Women in FinTech Hackathon will culminate into the Women in FinTech summit on Friday 16th September at Mestil Hotel, Kampala; where the best performing teams and individuals from across East Africa will be announced and receive their share of the USD 10,000 collective prize money. The best teams will also automatically qualify for the Women in FinTech Incubator program that will run until January 2023.