Best Mobile Financial Service for Africa: Nominees Review

The annual Digital Impact Awards Africa (DIAA2016) has released a review of the nominees for Best Mobile Financial Service (MFS) for Africa. The nominees reviewed are: Airtel Money, EcoCash, MTN Mobile Money, Orange Money, Safaricom/Vodafone M-Pesa and Tigo Cash whose key innovations across Africa are the center focus of the review.

“Ahead of the award event that will be held on 17th August 2016 at Kampala Serena Hotel, the review gives insight into the innovation that Airtel Money, EcoCash, MTN Mobile Money, Orange Money, Safaricom/Vodafone M-Pesa and Tigo Cash have speared to improve delivery of services such as Person2Person transfers, bill payments, micro-loans, contactless merchant payments, bulk payments and airtime recharge” Innocent Kawooya, CEO of HiPipo noted.

He added “These services transform the way consumers save, borrow, transfer and spend money by integrating consumer touch points with a wide ecosystem of banks and merchants. DIAA2016 took keen interest in 3rd and 4th generation MFS product that include saving and lending innovation by the nominees”

The nominated and reviewed players of this category are doing a commendable job to improve financial inclusion in Africa. Under the theme “Maximizing the Digital Dividend”, the DIAA2016 focus on digital inclusion, financial inclusion and cybersecurity and celebrates these nominees for their innovation, encourage more innovations and will award the overall winner as would be delivered by DIAA2016 research and jury results.

Digital enabled saving and lending innovations are a cornerstone for concrete Financial Inclusion in Africa

Across most of Africa where mobile money is deployed, the services offer P2P transfers, airtime purchases, bank push and pull, paying utility bills as well as buying goods and services among others.

The DIAA Program supports ‘Deepening Financial Inclusion with 3G and 4G Mobile Financial Services’. DIAA definition of 3G and 4G in relation to MFS includes Mobile Banking (Push/Pull), Saving, MicroCredit and Insurance. We believe these services are a cornerstone for concrete Financial Inclusion in Africa. Among the innovations seen over the last years led by Airtel Money, EcoCash, MTN Mobile Money, Orange Money, Safaricom/Vodafone M-Pesa and Tigo Cash are these 3G and 4G Mobile Financial Services that form the center focus of review for nominees of Best Mobile Financial Service for Africa.

1 Airtel Money

- Saving and Lending Innovations

- Airtel Money Bosea: This is Ghana’s micro lending product. The product is a partnership between Airtel, Fidelity Bank Ghana and Tiaxa which provides small loans to Ghanaians through their mobile money wallets.

- Airtel Tanzania in partnership with JUMO Tanzania Ltd, launched a loan service to its dubbed “Timiza Wakala Loans”.

- Airtel Money and FDH Bank in Malawi launched of a loan product called ‘Kutchova Loan’.

- Airtel Kenya and Faulu Kenya are running a microcredit product “Kopa Chapaa”

- Merchant payments, Bank Push and Pull, Transfers Innovations

- In most of its operations across Africa, Airtel Money has launched more merchant payment, bank push and pull integration and remittance services.

- Delivered with Mahindra Comviva, Airtel Tanzania recently launched “Tap Tap” NFC payments. “Tap Tap” NFC Payments facilitates fast and seamless payments at merchant POS and also addresses key customer and merchant related adoption challenges and brings a paradigm shift in mobile money-based merchant payments, which so far, are performed predominantly using USSD and SMS.

2 EcoCash

- Saving and Lending Innovations

- EcoCash Save Service: This is a paperless banking service offered through ECOCASH that enables customers to open and operate an EcoCash Save bank account through mobile phone, without having to visit any bank.

- EcoCash Loans: Saving with EcoCash Save earns interest and customers can obtain loans anytime of the day from anywhere using mobile phone.

- Merchant payments, Bank Push and Pull, Transfers Innovations

- Ecocash offers merchant payments, transfers, international remittance, bank push and pull transaction among other services

- Econet Wireless has airtime credit service via the EcoCash platform that allows more customers to borrow airtime using EcoCash.

- EcoCash has a Debit Card in partnership with MasterCard. The card is directly linked to EcoCash wallet and allows customers to pay for goods and services locally and internationally and online.

- Ecocash has recently introduced a product, called EcoCash Ta! that uses NFC technology.

3 MTN Mobile Money

- Saving and Lending Innovations

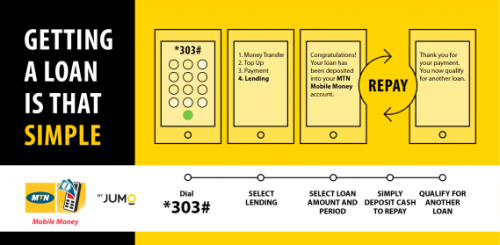

- In partnership with Jumo, MTN Zambia Mobile Money launched “KONGOLA”. Kongola enables MTN Mobile Money subscribers to get access to finance at varying amounts depending on their credit history on their wallet accounts and their earlier loan repayment speeds. The loan is paid directly into customers MTN Mobile Money Wallet with no bank account or security needed.

- Merchant payments, Bank Push and Pull, Transfers innovations

- MTN Mobile Money offers merchant payments, transfer, international remittance, bank push and pull transaction among other services across many of its operation in Africa. These service are doing a good job to increase the financial inclusion.

- Digital money transfer services such as WorldRemit, MFS Africa among others and MTN have launched instant international remittances to MTN Mobile Money wallets in different operation of MTN across Africa.

4 Safaricom/Vodafone M-PESA

- Saving and Lending Innovations

- M-Shwari is a first in several important ways. It is the first successful formal banking account layered on a mobile wallet already used by two-thirds of the population in Kenya. It is also the first scaled loan product targeting the mass market using digital data to score them. Reliable, private, and easy access to small amounts of liquidity when needed has been a huge gap in the financial portfolios of most of Africa, and M-Shwari seems to meet this need and has thus been the market eye opener. M-Shwari is delivered by Safaricom in partnership with CBA.

- M-KOPA- With an up-front cost of 35 dollars and daily payment of 50 cents for one year, Kenyans, Ugandans, and Tanzanians who live off-the-grid can get energy access through solar company M-Kopa. M-Kopa’s key innovation is using the mobile phone to show how solar energy can be marketed at scale in Africa using a credit model.

- Merchant payments, Bank Push and Pull, Transfers

- Nearly a decade after its launch, M-Pesa has transformed economic interaction across Africa. In Kenya, its success reshaped Kenya’s banking and telecom sectors, extended financial inclusion for nearly 20 million Kenyans, and facilitated the creation of thousands of small businesses. M-PESA has been replicated across Africa delivered by Vocacom/Vodafone and has been the base inspiration for other operators’ innovations in many ways.

- In most of its operations across Africa, M-PESA has launched more merchant payment, bank push and pull integration and remittance services that have further improved financial inclusion.

5 Orange Money

- Orange money has launched more merchant payment, bank push and pull integration and remittance services. With strong operation in West and French speaking countries, Orange money has a commendable impact on financial inclusion in Africa.

6 Tigo Cash

- Across Africa, Tigo cash has launched more merchant payment, bank push and pull integration and remittance services that are impacting financial inclusion and bettering the lives of many Africans.

- Recently Tigo Tanzania in partnership with JUMO launched an innovative mobile money lending scheme for its subscribers requiring no collateral to access the loans. The nano-lending scheme known as Tigo Nivushe allows a Tigo Pesa users to immediately access micro loans.

- In Rwanda, Tigo Sugira is a Mobile Saving account which allows for you to deposit and withdraw.

Access theDetail Nominees Review

In order to access the detail review of Best Mobile Financial Service for Africa nominees on the DIAA website, Purchase a DIAA package and you will receive access details for this content.

[button href=”http://www.digital-impact-awards.com/#awards-dinner” text=”BUY Your DIAA Package” color=”orange” size=”large-x” text-color=”#fff” bg-color=”#990000” align=”center” target=”_blank”]\

[restrict userlevel=”editor”]

Table analysis

[/restrict]

Attend DIAA2016 Event at Kampala Serena Hotel on August 17th 2016

- Event Attendance(Tickets/Tables): DIAA is one of the most anticipated events of the year to celebrate digital excellence in Africa. DIAA gala night guarantees excitement and invaluable networking opportunities with the best digital pros in Africa, it is Africa’s largest gathering of digital pros. To attend the awards dinner, please book tables for your organization’s teams and select customers in good time.

- Exhibition opportunities are available for organisations that take on DIAA platinum or diamond packages.

Digital Impact Awards Africa is a production of HiPipo in partnership with Cyberplc and AdBank.